Is Your Business Affected by New Company Size Thresholds?

On 6 April 2025, the company sized thresholds for micro, small and medium-sized business changed for the first time since 2013. This was to reflect inflation and to have a growing focus on proportionality.

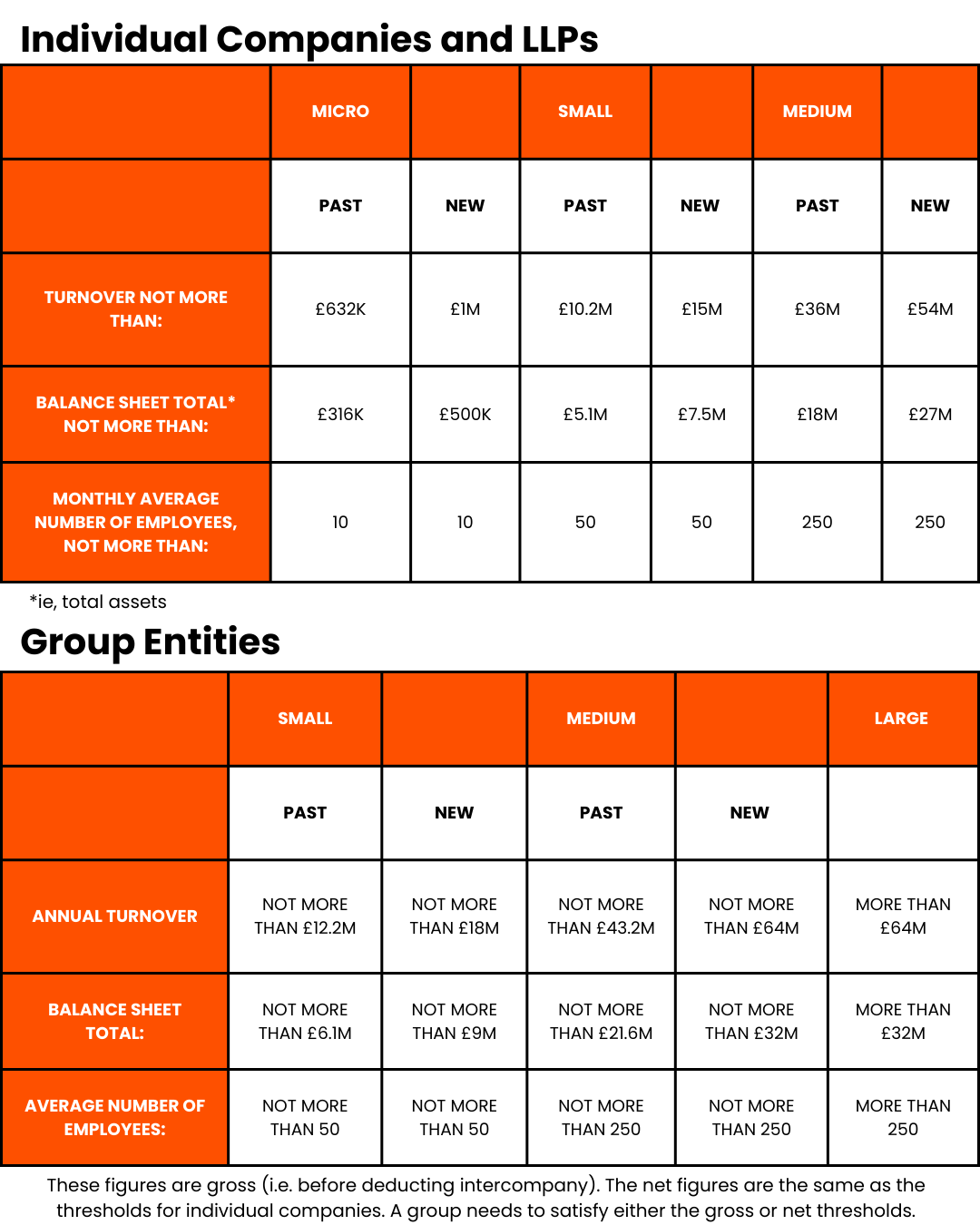

WHAT ARE THE NEW SIZE THRESHOLDS?

WHEN DOES THIS AFFECT BUSINESSES?

The change to company size thresholds applies for accounting periods beginning on or after 6 April 2025. For example – when a company has a 30 June year end, it cannot use the new size thresholds to calculate its size for the year ended 30 June 2025, due to the accounting period beginning prior to 6 April 2025. The new thresholds will apply for the year ended 30 June 2026.

Affected companies can also apply a transitional provision, permitting the application of the new size thresholds to both the current and previous financial years for their first set of financial statements when determining their size.

WHAT’S THE IMPACT?

The Government estimates that the new regulations will result in:

• 113,000 companies and LLPs moving from the small to micro-entity category

• 14,000 moving from medium-sized to small

• 6,000 moving from large to medium-sized.

Companies moving into a lower size category may benefit from reduced reporting or audit requirements:

- Audit exemption – some businesses will no longer be required to undergo a statutory audit, subject to implications of group membership

- Narrative reporting – reduced requirements in the Strategic Report and Directors’ Report to the financial statements may apply

- SECR – Streamlined Energy & Carbon Reporting (SECR) disclosures are aligned to the previous large size thresholds with no plans to change. As a result, some businesses that now qualify as medium-sized may still be required to include SECR disclosures in the Directors’ Report under the original large company criteria.

DOES THIS BENEFIT BUSINESSES?

These changes are designed to reduce the compliance burden on smaller businesses and cut complexity with an estimated saving of more than £240m per year to UK companies, but they also require careful consideration by directors, finance teams and advisors, especially for companies on the borderline of existing thresholds.

The revised thresholds will be a welcome development for many small businesses that were at risk of breaching the audit criteria as a result of upcoming changes to FRS 102. This is set to take effect from accounting periods beginning on or after 1 January 2026, and will require operating leases to be recognised on the balance sheet. For businesses with significant leased assets, this change could have pushed total assets above the current limit, increasing the likelihood of triggering an audit requirement.

NEXT STEPS

Companies should assess how these changes impact their current and upcoming accounting periods. For some, this may be an opportunity to simplify compliance; for others, a prompt to reassess their financial reporting approach.

If you’d like to discuss and understand the changes for your business, contact us today.